Titan Discovers New Zone of High-Grade Mineralization, Sets Production Guidance and Announces Inaugural Dividend

Vancouver, B.C., July 15, 2021 – Titan Mining Corporation (TSX: TI) (“Titan” or the “Company”) today provided an update on its surface exploration drilling program and the discovery of Little York, set H2/21 production guidance for its 100% owned Empire State Mine (“ESM”) located in upstate New York, and announces an inaugural dividend.

Highlights:

- Discovery of Little York - drilling included 11 ft of 18.4% zinc within 20 ft of 11% zinc; 4 ft of 25% zinc within 7.6 ft of 15.4% zinc

- ESM H2/21 production forecasted at 26M payable lbs at AISC of US$0.88/lb

- Plans to retire a portion of debt

- Plans to initiate a dividend to shareholders in H2/21 with the first to be declared in Q3 2021

Little York Discovery

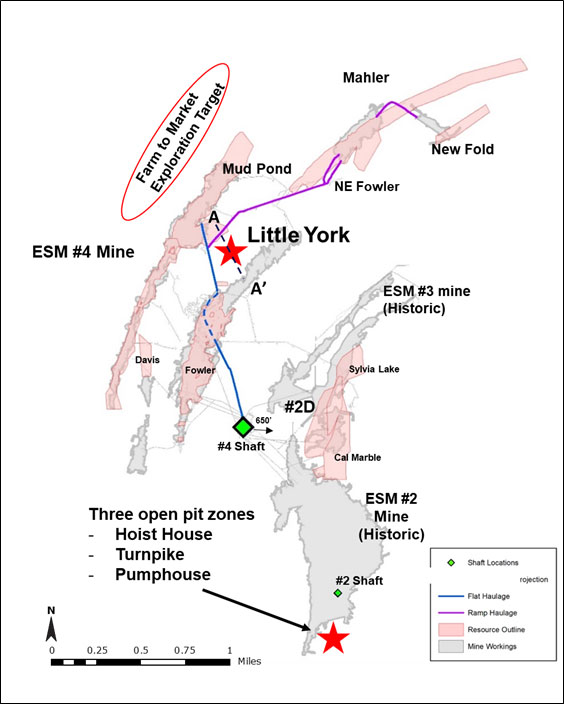

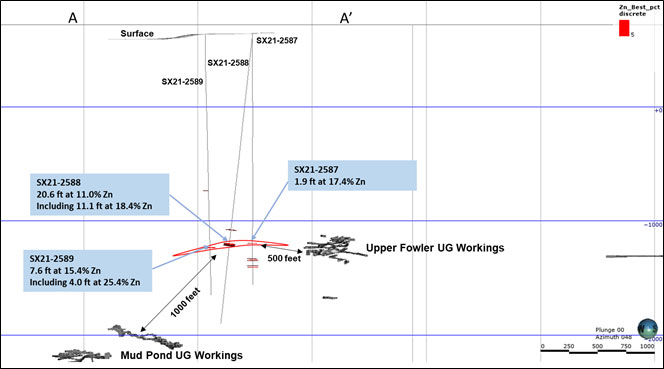

Surface drilling has discovered Little York, a new zone of high-grade zinc mineralization between Mud Pond, currently an active mining area, and the historically mined Upper Fowler zone.

Scott Burkett, the Company’s Vice President, Exploration, stated “Our drilling continues to deliver positive results that will ultimately extend mine life and enhance our production profile. Drilling at Little York has intersected substantial zinc grades over mineable widths that remain open along strike and down dip. Little York will be a priority target going forward as it has the potential to add to our production profile as we continue to increase our mine throughput through various initiatives.”

Additional detail on the Little York discovery is provided below.

ESM Production Update

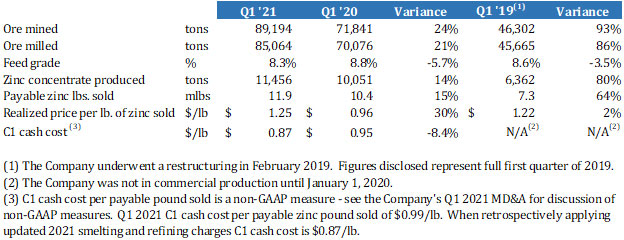

Mining and milling operations at ESM continue to improve in both production and safety. Production highlights comparing Q1 2021 to Q1 2019 (since the restructuring) from Table 1 below are as follows:

- Tons mined are up 93%

- Tons milled are up 86%

- Ore grade milled is down 3.5%

- Concentrate produced up 80%

- Payable zinc lbs. sold were up 64%

- Realized price per lb. of zinc sold up 2%

- C1 cash cost per payable zinc lb. sold down 8.4% (when retrospectively applying updated 2021 smelting and refining charges) compared to the first quarter of 2020 when commercial production was achieved.

Table 1

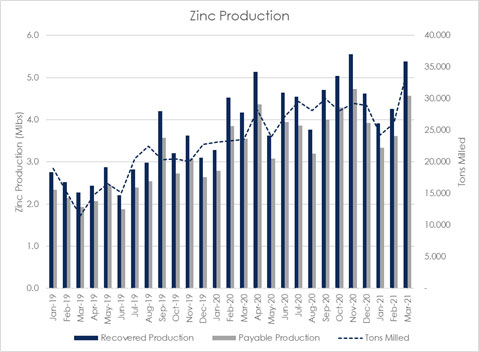

The following figure depicts the improvement in recovered production, payable production and tons milled since the 2019 restructuring:

Figure 1

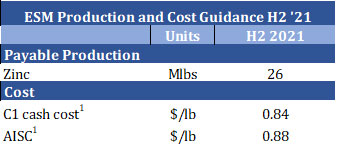

During the second half of 2021, the bulk of production at ESM will continue to come from the New Fold, Mahler, and Mud Pond zones of the #4 Mine. Additionally, mining has recommenced on the #2D zone which had been suspended during the zinc price downturn. Permitting efforts continue to facilitate mining of the #2 open pit projects, and work has begun to prepare the area for mining of a bulk sample from the Pumphouse Pit in the second half of 2021. In H2/21, ESM is forecasted to produce at least 26 million payable pounds of zinc metal in concentrate at an AISC of approximately US$0.88 (refer to Table 2).

Table 2

- C1 cash cost per payable pound sold is a non-GAAP measure. All-in sustaining cost per payable pound sold (“AISC”) is calculated as C1 cash cost plus sustaining capital to maintain the mine and mill per pound sold. All-In Sustaining Cost per pound of zinc payable produced does not include depreciation, depletion, and amortization, reclamation and exploration expenses. See the Company’s Q1 2021 MD&A for discussion of non-GAAP measures.

CEO, Don Taylor commented, “We continue to see steady and marked improvement in both safety and production at the ESM operation. It is clear from the quarterly comparisons that those improvements are translating into lower cash costs and higher profitability. Additionally, we are considering several initiatives that have the potential to increase mill throughput in the short-term while maintaining or reducing our costs. These improved results will allow us to retire certain debt obligations and fund an inaugural dividend to our shareholders. Overall, we are positioning the operations to be a long-term mining operation with margins that will allow us to be profitable regardless of external operating conditions.”

Drilling at Little York

The Little York target is situated between Upper Fowler and Mud Pond, two known mineralized trends in the ESM #4 mine. Upper Fowler was historically mined and is located 500 feet to the east of Little York at approximately the same elevation. Mud Pond, currently an active mining area, is situated approximately 1,000 feet below Little York.

Surface exploration drilling consisting of three holes intercepted high-grade zinc mineralization along a flat lying structural zone. The three holes were designed to test the presence of mineralization over a 500-foot-wide corridor. All three drill holes intercepted high-grade mineralization with the second hole intercepting the thickest interval of mineralization potentially representing the core of the mineralized trend. The mineralization remains open along strike to the south and north. Follow up drilling will consist of multiple step-out holes to test the continuity of mineralization along strike to the south in an area that has not been drill tested.

Table 3 - Little York Exploration Drill Results

| Drillhole | From (ft) | To (ft) | Interval (ft) | From (m) | To (m) | Interval (m) | Zn % | Zone |

|---|---|---|---|---|---|---|---|---|

| SX21-2587 | 1833.9 | 1835.8 | 1.9 | 559.0 | 559.6 | 0.6 | 17.4 | Little York |

| SX21-2587 | 1965.6 | 1966.4 | 0.8 | 599.1 | 599.4 | 0.2 | 15.4 | Lower |

| SX21-2587 | 1977.2 | 1978.1 | 0.9 | 602.7 | 602.9 | 0.3 | 5.6 | Lower |

| SX21-2587 | 1984.7 | 1986.3 | 1.6 | 604.9 | 605.4 | 0.5 | 7.4 | Lower |

| SX21-2587 | 2029.5 | 2030.0 | 0.5 | 618.6 | 618.7 | 0.2 | 6.5 | Lower |

| SX21-2587 | 2042.9 | 2045.6 | 2.7 | 622.7 | 623.5 | 0.8 | 6.6 | Lower |

| SX21-2588 | 1728.2 | 1728.8 | 0.6 | 526.7 | 526.9 | 0.2 | 7.3 | Upper |

| SX21-2588 | 1849.0 | 1869.6 | 20.6 | 563.6 | 569.9 | 6.3 | 11.0 | Little York |

| including | 1851.2 | 1862.3 | 11.1 | 564.2 | 567.6 | 3.4 | 18.4 | Little York |

| SX21-2589 | 1370.2 | 1372 | 1.8 | 417.6 | 418.2 | 0.5 | 8.2 | Upper |

| SX21-2589 | 1869.2 | 1876.8 | 7.6 | 569.7 | 572.0 | 2.3 | 15.4 | Little York |

| including | 1872.8 | 1876.8 | 4 | 570.8 | 572.0 | 1.2 | 25.4 | Little York |

Note: It is not possible to determine the true width of the zone(s) based on the drill density and no representation is made here regarding true width of the zone(s).

Table 4 – Little York Coordinates

| Hole ID | Easting (ft) | Northing (ft) | Elevation (ft) | Depth (ft) | Dip | Azimuth |

| SX21-2587 | 14,607.30 | 13,311.55 | 640.02 | 2,197.00 | -90.00 | 300.00 |

| SX21-2588 | 14,610.18 | 13,312.56 | 641.41 | 2,557.00 | -85.00 | 300.00 |

| SX21-2589 | 14,351.72 | 13,607.16 | 636.71 | 2,287.00 | -90.00 | 0.00 |

Note: The coordinates are in a local mine grid (ft).

Figure 2 – Plan View of ESM Mineralized Zones

Figure 3 – Cross-section of Little York Mineralization (Looking NE)

Qualified Person

The scientific and technical information contained in this news release and the sampling, analytical and test data underlying the scientific and technical information has been reviewed, verified and approved by Scott Burkett, Vice President, Exploration of Titan who is a “Qualified Person” under National Instrument 43-101- Standards of Disclosure for Mineral Projects. The data was verified using data validation and quality assurance procedures under high industry standards. Mr. Burkett has over 14 years of mineral exploration experience and is a Registered Member through the SME (registered member # 4229765).

Assays and Quality Assurance/Quality Control

To ensure reliable sample results, the Company has a rigorous QA/QC program in place that monitors the chain-of-custody of samples and includes the insertion of blanks and certified reference standards at statistically derived intervals within each batch of samples. Core is photographed and split in half with one-half retained in a secured facility for verification purposes.

Sample preparation (crushing and pulverizing) has been performed at ALS Geochemistry (“ALS”), an independent ISO/IEC accredited lab located in Sudbury, Ontario, Canada. ALS prepares a pulp of all samples and sends the pulps to their analytical laboratory in Vancouver, B.C., Canada, for analysis. ALS analyzes the pulp sample by an aqua regia digestion (ME-ICP41 for 35 elements) with an ICP – AES finish including Cu (copper), Pb (lead), and Zn (zinc). All samples in which Cu (copper), Pb (lead), or Zn (zinc) are greater than 10,000 ppm are re-run using aqua regia digestion (Cu-OG46; Pb-OG46; and Zn-OG46) with the elements reported in percentage (%). Silver values are determined by an aqua regia digestion with an ICP-AES finish (ME-ICP41) with all samples with silver values greater than 100 ppm repeated using an aqua regia digestion overlimit method (Ag-OG46) calibrated for higher levels of silver contained. Gold values are determined by a 30 g fire assay with an ICP-AES finish (Au-ICP21).

The Company has not identified any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data set out in this news release.

About Titan Mining Corporation

Titan is an Augusta Group company which produces zinc concentrate at its 100%-owned Empire State Mine located in New York state. Titan is built for growth, focused on value and committed to excellence. For more information on the Company, please visit our website atwww.titanminingcorp.com.

Contact

For further information, please contact:

Investor Relations:

Email: info@titanminingcorp.com

Cautionary Note Regarding Forward-Looking Information

Certain statements and information contained in this new release constitute "forward-looking statements", and "forward-looking information" within the meaning of applicable securities laws (collectively, "forward-looking statements"). These statements appear in a number of places in this new release and include statements regarding our intent, or the beliefs or current expectations of our officers and directors, including that our drilling continues to deliver positive results that will ultimately extend mine life and enhance our production profile; that Little York will be a priority going forward as it has the potential to add to our production profile as we continue to increase our mine throughput through various initiatives; that follow up drilling will consist of multiple step-out holes to test the continuity of mineralization along strike to the south in an area that has not been drill tested; during the second half of 2021; the bulk of production at ESM will continue to come from the New Fold, Mahler, and Mud Pond zones of the #4 Mine; permitting efforts continue ahead of planned mining of the #2 open pit projects; as permitting progresses work has begun to prepare the area for mining of a bulk sample from the Pumphouse Pit scheduled for the second half of 2021; ESM H2/21 production forecasted at 26M payable lbs at AISC of US$0.88/lb; that the Company plans to retire a portion of its debt; that we are positioning the operations to be a long-term mining operation with margins that will allow us to be profitable regardless of external operating conditions; and that the Company plans to initiate a dividend (and the timing of that dividend).

When used in this news release words such as “to be”, "will", "planned", "expected", "potential", and similar expressions are intended to identify these forward-looking statements. Although the Company believes that the expectations reflected in such forward-looking statements and/or information are reasonable, undue reliance should not be placed on forward-looking statements since the Company can give no assurance that such expectations will prove to be correct. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to vary materially from those anticipated in such forward-looking statements, including the risks, uncertainties and other factors identified in the Company's periodic filings with Canadian securities regulators. Such forward-looking statements are based on various assumptions, including assumptions made with regard to the ability to advance exploration efforts at ESM; the results of such exploration efforts; the ability to secure adequate financing (as needed); the Company maintaining its current strategy and objectives; and the Company’s ability to achieve its growth objectives. While the Company considers these assumptions to be reasonable, based on information currently available, they may prove to be incorrect. Except as required by applicable law, we assume no obligation to update or to publicly announce the results of any change to any forward-looking statement contained herein to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking statements. If we update any one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements. You should not place undue importance on forward-looking statements and should not rely upon these statements as of any other date. All forward-looking statements contained in this news release are expressly qualified in their entirety by this cautionary statement.