Titan Mining Announces Mineral Resource Increase and Commences Study of 3,000-Tons-Per-Day Life-of-Mine Plan at Empire State Mines

Vancouver, B.C., April 10, 2018 – Titan Mining Corporation (“Titan” or the “Company”) (TSX:TI) today announced an updated mineral resource at Empire State Mines’ #4 mine in northern New York State. The Company expects to file an updated preliminary economic analysis (“PEA”) technical report under National Instrument 43-101 within 45 days. Unless otherwise noted, financial information is presented in U.S. dollars.

Highlights

- The inferred mineral resources increase by 3.1 million tons, or 138%, to 5.4 million tons at an undiluted grade of 12.50% zinc from the previous estimate of 2.3 million tons at an undiluted grade of 13.37% zinc(1).

- The mineral resource expansion is based on an initial review of existing data on remnants at the Empire State Mines’ #4 mine only.

- Potential exists for additional remnant resources at the Empire State Mines, with further resource potential from zone extensions and regional exploration.

- The updated PEA is based on the existing mine plan, and the main update from the 2017 PEA(1) is the inclusion of the economic impact of U.S. tax reform(2).

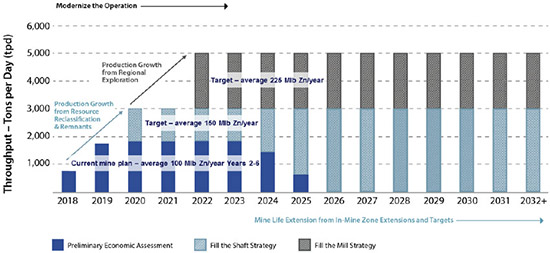

- Commenced study on expansion to 3,000 tons per day life-of-mine in 2020, incorporating additional resources into a new mine plan.

“The inferred mineral resources at the #4 mine have more than doubled since April 2017,” said Scott Burkett, Vice President, Exploration, “showing the tremendous potential for resource addition at the Empire State Mines, which underpins our growth strategy. We are in the process of digitizing 100 years of exploration data and see further resource upside as additional data is reviewed. Remnants in the #2 and #3 mines and other areas in the #4 mine have the potential to add multiples of the current incremental mineral resource.”

Eric Strom, Vice President, Projects and Innovation, stated, “We are excited about this mineral resource update, as it is key to our future. We have improved the potential for additional production areas and are now considering which advanced technologies we will use to boost productivity – both are important steps towards achieving our objectives of levering excess capacity and producing at a rate of 3,000 tons per day by 2020 and 5,000 tons per day by 2022.”

- Refer to the technical report entitled “NI 43-101 Preliminary Economic Assessment Technical Report on the Empire State Mines, Gouverneur, New York, USA”, dated September 19, 2017 (“2017 PEA”); the mineral resource estimate in the 2017 PEA is dated April 6, 2017.

- H.R. 1 – Tax Cuts and Jobs Act of 2017.

Note: The preliminary economic assessment is preliminary in nature, includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the preliminary economic assessment will be realized. The basis for the preliminary economic assessment and any qualifications and assumptions are made by the Qualified Person as disclosed in this release.

Updated Mineral Resources

The inferred mineral resources increased by approximately 3.1 million tons at an undiluted grade of 11.88% zinc. The additional mineral resources are located in the Mud Pond, Sylvia Lake and Fowler mineralized zones at the Empire State Mines’ #4 mine, and are based on an initial review of known data on remnants. Remnants include historic mineralized material write-downs mainly from 1985, and pillars left in place to provide structural support during previous mining operations.

Tables 1 and 2 summarize the mineral resources at the Empire State Mines’ #4 mine as at January 31, 2018, and April 6, 2017, respectively.

Table 1 - Mineral Resources at Empire State Mines’ #4 Mine as at January 31, 2018

| Mineralized Zones | Measured | Indicated | Measured and Indicated | Inferred | ||||

| ‘000 Tons |

Grade (% Zinc) |

‘000 Tons |

Grade (% Zinc) |

‘000 Tons |

Grade (% Zinc) |

‘000 Tons |

Grade (% Zinc) |

|

| Mud Pond | 337.0 | 10.40 | 285.2 | 10.87 | 622.2 | 10.61 | 1,390.5 | 10.68 |

| New Fold | 68.0 | 12.75 | 249.6 | 11.72 | 317.6 | 11.94 | 539.4 | 13.97 |

| Mahler | 400.5 | 15.89 | 700.9 | 15.27 | 1,101.4 | 15.50 | 516.6 | 15.59 |

| Other Mineralization | 44.9 | 10.73 | 83.5 | 10.16 | 128.4 | 10.36 | 2,969.6 | 12.55 |

| Total | 850.4 | 13.19 | 1,319.2 | 13.33 | 2,169.6 | 13.27 | 5,416.1 | 12.50 |

Table 2 - Mineral Resources at Empire State Mines’ #4 Mine as at April 6, 2017

| Mineralized Zones | Measured | Indicated | Measured and Indicated | Inferred | ||||

| ‘000 Tons |

Grade (% Zinc) |

‘000 Tons |

Grade (% Zinc) |

‘000 Tons |

Grade (% Zinc) |

‘000 Tons |

Grade (% Zinc) |

|

| Mud Pond | 336.7 | 10.40 | 273.9 | 10.89 | 610.6 | 10.62 | 392.9 | 10.70 |

| New Fold | 68.0 | 12.75 | 249.6 | 11.72 | 317.6 | 11.94 | 539.4 | 13.97 |

| Mahler | 400.5 | 15.89 | 700.9 | 15.27 | 1,101.4 | 15.50 | 516.6 | 15.59 |

| Other Mineralization | 44.9 | 10.73 | 83.5 | 10.16 | 128.4 | 10.36 | 827.1 | 12.85 |

| Total | 850.1 | 13.19 | 1,307.9 | 13.35 | 2,158.0 | 13.29 | 2,276.0 | 13.37 |

Notes:

- Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that all, or any part of the mineral resources estimated will be converted into mineral reserves.

- The underground mining economics used operating costs of $70.00/ton, and a zinc price of $1.00/pound at 96% recovery.

- Mineral resources are reported in situ using a cut-off grade of 6% zinc to determine reasonable prospects for eventual economic extraction.

- Tonnage is reported to the nearest 100 tons, and grades are rounded to the nearest two decimal places.

- Rounding as required by reporting guidelines may result in apparent summation differences between tons and grade.

- Mineral resource estimates were completed by Allan Reeves, P.Geo., President of Tuun Consulting Inc.

The additional 3.1 million tons of inferred mineral resources are based primarily on historic drilling. Historic production from the Mud Pond, Sylvia Lake and Fowler zones at the #4 mine, as shown in Table 3, was based on the same drill data, and totalled more than 8 million tons at a diluted grade of 8.13%, demonstrating strong continuity in the mineralized zones.

Table 3 - Historic Production from Selected Zones at Empire State Mines’ #4 Mine

| Mineralized Zones | ‘000 Tons | Grade (% Zinc) |

| Mud Pond | 2,077.8 | 6.27 |

| Sylvia Lake | 413.7 | 5.88 |

| Fowler | 5,569.2 | 8.99 |

| Total | 8,060.8 | 8.13 |

Note: Grade of historic production includes mine dilution.

In addition to the remnants at the Empire State Mines, there is potential resource upside from in-mine zone extensions and regional exploration.

First Concentrate Shipped

Following the restart of hoisting at the Empire State Mines in late January, production ramped up to an average mining rate of 470 tons per day in March. Further progress has been made in April, with a month-to-date mining rate of over 700 tons per day. The first shipment of zinc concentrate took place in March under the previously-announced offtake agreement with Glencore (refer to Titan’s news release dated February 26, 2018). Commercial production remains on track for the second quarter of 2018, and more detail will be provided with the first quarter 2018 financial results.

Updated Preliminary Economic Assessment

An updated technical report for the Empire State Mines is expected to be filed within the next 45 days. The updated PEA reflects the economic impact of H.R. 1 – Tax Cuts and Jobs Act of 2017 and a slight increase in operating cost estimates due to higher labour and maintenance cost assumptions, in line with the modest inflation trends seen in the industry in recent months. Total gross project capital cost estimates remain relatively unchanged.

In the fourth quarter of 2018, the Company plans to incorporate the additional mineral resources into a new life-of-mine plan for the Empire State Mines’ #4 mine. A study has commenced on the expansion of production to 3,000 tons per day life-of-mine from 2020, and an extension of the estimated mine life beyond the initial eight years shown in Figure 1. It is anticipated that mining of the additional mineral resources will require the construction of a paste backfill plant. The capital expenditure required to expand the production rate is expected to be low relative to a greenfield project given the existing underutilized capacity, and extensive development providing access to the remnant areas.

Figure 1 - Growth Strategy: Levering Excess Capacity

Qualified Persons

The mineral resource estimate has been prepared under the guidelines of National Instrument 43-101 (“NI 43-101”) for reporting of mineral resources. Keith Boyle, P.Eng., Chief Operating Officer of Titan Mining Corp. and Qualified Person (“QP”) under NI 43-101, reviewed and approved the technical content of this news release. The updated PEA was conducted under the overall review of Michael Makarenko, P.Eng., of JDS Energy and Mining Inc. of Vancouver, British Columbia, who serves as Principal Author of the updated PEA.

The following independent QPs have assumed authorship of the technical report:

- Michael Makarenko P.Eng., JDS Energy and Mining Inc.

- Matt Moss P.Eng., JDS Energy and Mining Inc.

- Indi Gopinathan, P.Eng., JDS Energy and Mining Inc.

- Allan Reeves P.Geo., Tuun Consulting Inc.

- Robert Raponi P.Eng., TR Raponi Consulting Ltd.

Cautionary Note on Mineral Resources

Mineral resources were estimated in conformity with CIM’s “Estimation of Mineral Resource and Mineral Reserve Best Practice Guidelines”. Mineral resources are not mineral reserves and have no demonstrated economic viability. The PEA does not support an estimate of mineral reserves, as a pre-feasibility study or feasibility study is required for reporting of mineral reserve estimates. The PEA is based on mine plan tonnage (mine plan tons and/or mill feed). Inferred mineral resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that all or any part of the mineral resources or mine plan tons would be converted into mineral reserves.

About Titan Mining Corporation

Titan is a Canadian-based zinc exploration and development company which has as its principal asset the Empire State Mines in the State of New York. For more information on the Company, please visit our website at www.titanminingcorp.com.

Contact

For further information, please contact:

Jerrold Annett – Senior Vice President, Corporate Development

Telephone: 416-366-5678 Ext. 207 | Email: jannett@titanminingcorp.com

Jacqueline Allison – Vice President, Investor Relations and Strategic Analysis

Telephone: 416-366-5678 Ext. 205 | Email: jallison@titanminingcorp.com

Cautionary Note Regarding Forward-Looking Information

This press release contains certain forward-looking statements. Words such as “expects”, “anticipates” and “intends” or similar expressions are intended to identify forward-looking statements. Forward-looking information is necessarily based on a number of opinions, assumptions and estimates that, while considered reasonable by the Company as of the date of this press release, are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, use of proceeds or timing of events to be materially different from those expressed or implied by such forward-looking information, including, but not limited to, the factors described in greater detail in the “Risks and Uncertainties” section and other sections of the Company’s Management’s Discussion and Analysis for the year ended December 31, 2017, available at www.sedar.com. No securities regulatory authority has expressed an opinion about the securities described herein and it is an offence to claim otherwise. Titan undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law.