Solaris Reports 600m of 1.0% CuEq and 462m of 1.0% CuEq From Surface, Continued Expansion of Warintza Central

February 22, 2021 – Vancouver, B.C. – Solaris Resources Inc. (TSX: SLS; OTCQB: SLSSF) ("Solaris" or the "Company") is pleased to report assay results from a series of additional holes from the ongoing diamond drilling program at its Warintza Project (“Warintza” or “the Project”) in south-eastern Ecuador.

Highlights from recent drilling are listed below and results are summarized in Tables 1 and 2. An updated 3D model will be posted on the Company’s website when available.

Highlights

- Four additional holes, as detailed below, have returned long intervals of high-grade mineralization starting from surface, extending the limits of mineralization to the west and northwest

- SLS-10 was an extensional hole collared at the western limit of drilling and drilled to the west, returning 600m of 1.00% CuEq¹ (0.83% Cu, 0.02% Mo, and 0.12 g/t Au), including 546m of 1.06% CuEq¹ (0.88% Cu, 0.03% Mo, and 0.12 g/t Au) from surface, significantly extending mineralization in this direction

- The high-grade interval of 600m of 1.00% CuEq¹ reported in SLS-10 corresponds to a high conductivity anomaly reflecting sulphide stockwork mineralization that continues to the west for a further 1.5km at or near surface and is being targeted in follow-up extensional drilling that is now underway

- SLS-11 was an extensional hole collared in the southeastern portion of the current Warintza Central drill pattern and drilled to the northwest into an open area, returning 688m of 0.57% CuEq¹ (0.39% Cu, 0.04% Mo, and 0.05 g/t Au) from surface

- SLS-12 returned 736m of 0.74% CuEq¹ (0.59% Cu, 0.03% Mo, and 0.07 g/t Au) from near surface, extending mineralization into an undrilled, open area between the eastern and western drilling at Warintza Central

- SLS-13 stepped out approximately 100m beyond the western limit of Warintza Central drilling and was drilled north into an open area, returning 462m of 1.00% CuEq¹ (0.80% Cu, 0.04% Mo, and 0.09 g/t Au) from surface, with the hole ending prematurely in strong mineralization

- To date, 17,400 metres have been drilled at Warintza Central in 21 holes of which results have been reported for 13; drilling is ongoing with six rigs currently operating and six more being added by mid-year, which will lead to a commensurate increase in the pace of results being reported

Mr. Jorge Fierro, Vice President, Exploration, commented: “Our drilling continues to demonstrate significant extensions of mineralization at Warintza Central with the latest results extending high-grade mineralization to the west, a direction in which the high-conductivity anomaly that correlates to high grade mineralization at Warintza Central continues for a further 1.5 km at or near surface and is being targeted in ongoing and planned drilling.”

Table 1 – Warintza Central Assay Results

| Hole ID | Date Reported | From (m) | To (m) | Interval (m) | Cu (%) | Mo (%) | Au (g/t) | CuEq¹ (%) | ||

| SLS-13 | Feb 22, 2021 | 6 | 468 | 462 | 0.80 | 0.04 | 0.09 | 1.00 | ||

| SLS-12 | 22 | 758 | 736 | 0.59 | 0.03 | 0.07 | 0.74 | |||

| SLS-11 | 6 | 694 | 688 | 0.39 | 0.04 | 0.05 | 0.57 | |||

| SLS-10 | 2 | 602 | 600 | 0.83 | 0.02 | 0.12 | 1.00 | |||

| Including | 56 | 602 | 546 | 0.88 | 0.03 | 0.12 | 1.06 | |||

| SLS-09 | 122 | 220 | 98 | 0.60 | 0.02 | 0.04 | 0.71 | |||

| Including | 122 | 168 | 46 | 0.96 | 0.03 | 0.05 | 1.09 | |||

| SLS-08 | Jan 14, 2021 | 134 | 588 | 454 | 0.51 | 0.03 | 0.03 | 0.62 | ||

| SLS-07 | 0 | 1067 | 1067 | 0.49 | 0.02 | 0.04 | 0.60 | |||

| SLS-06 | Nov 23, 2020 | 8 | 892 | 884 | 0.50 | 0.03 | 0.04 | 0.62 | ||

| SLS-05 | 18 | 936 | 918 | 0.43 | 0.01 | 0.04 | 0.50 | |||

| SLS-04 | 0 | 1004 | 1004 | 0.59 | 0.03 | 0.05 | 0.71 | |||

| SLS-03 | Sep 28, 2020 | 4 | 1014 | 1010 | 0.59 | 0.02 | 0.10 | 0.71 | ||

| SLS-02 | 0 | 660 | 660 | 0.79 | 0.03 | 0.10 | 0.97 | |||

| SLS-01 | Aug 10, 2020 | 1 | 568 | 567 | 0.80 | 0.04 | 0.10 | 1.00 | ||

| Notes to table: Grades are uncut and true widths have not been determined. | ||||||||||

Table 2 – Collar Locations for New Drill Holes

| Hole ID | Easting | Northing | Elevation (m) | Depth (m) | Azimuth (degrees) | Dip (degrees) |

| SLS-13 | 799667 | 9648029 | 1499 | 468 | 0 | -80 |

| SLS-12 | 800124 | 9648035 | 1568 | 782 | 265 | -62 |

| SLS-11 | 800191 | 9648059 | 1570 | 860 | 280 | -65 |

| SLS-10 | 799765 | 9648033 | 1571 | 690 | 293 | -77 |

| SLS-09 | 800266 | 9648209 | 1493 | 500 | 0 | -89 |

| Notes to table: The coordinates are in WGS84 17S Datum. | ||||||

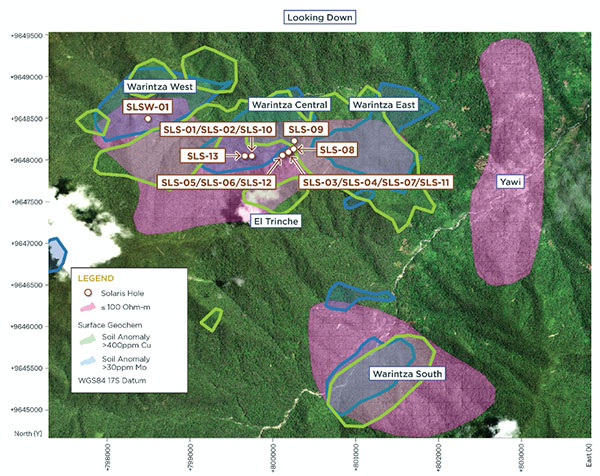

Image 1 – Plan View

Technical Information and Quality Control & Quality Assurance

Sample assay results have been independently monitored through a quality control/quality assurance (“QA/QC”) program that includes the insertion of blind certified reference materials (standards), blanks and field duplicate samples. Logging and sampling are completed at a secured Company facility located in Quito, Ecuador. Drill core is cut in half on site and samples are securely transported to ALS Labs in Quito. Sample pulps are sent to ALS Labs in Lima, Peru and Vancouver, Canada for analysis. Total copper and molybdenum contents are determined by four-acid digestion with AAS finish. Gold is determined by fire assay of a 30-gram charge. ALS Labs is independent from Solaris. In addition, selected pulp check samples are sent to Bureau Veritas lab in Lima, Peru. Solaris is not aware of any drilling, sampling, recovery or other factors that could materially affect the accuracy or reliability of the data referred to herein.

Qualified Person

The scientific and technical content of this press release and the sampling, analytical and test data underlying the scientific and technical content has been compiled, reviewed, approved, and verified by Jorge Fierro, M.Sc., DIC, PG, Vice President Exploration of Solaris who is a “Qualified Person” as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects. The data was verified using data validation and quality assurance procedures under high industry standards. ZTEM data quality was validated by a qualified external professional.

On behalf of the Board of Solaris Resources Inc.

“Daniel Earle”

President & CEO, Director

For Further Information

Jacqueline Wagenaar, VP Investor Relations

Direct: 416-366-5678 Ext. 203

Email: jwagenaar@solarisresources.com

About Solaris Resources Inc.

Solaris is advancing a portfolio of copper and gold assets in the Americas, which includes: a high-grade resource with expansion and additional discovery potential at the Warintza copper and gold project in Ecuador; discovery potential on the grass-roots Tamarugo project in Chile and Capricho and Paco Orco projects in Peru; exposure to US$130M spending / 5-yrs through a farm-out agreement with Freeport-McMoRan on the Ricardo Project in Chile; and significant leverage to increasing copper prices through the 60%-interest in the development-stage La Verde joint-venture project with Teck Resources in Mexico.

Cautionary Notes and Forward-looking Statements

This document contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). The use of the word “will” and “planned” and similar expressions are intended to identify forward-looking statements. These statements include statements regarding our intent, or the beliefs or current expectations of our officers and directors, including statements made with respect to future drilling plans, that an updated 3D model will appear on the Company’s website when available, that six more drill rigs will be added by mid-year; and that the addition of these drill rigs will lead to commensurate increase in the pace of results being reported. Although Solaris believes that the expectations reflected in such forward-looking statements and/or information are reasonable, undue reliance should not be placed on forward-looking statements since Solaris can give no assurance that such expectations will prove to be correct. These statements are based on a variety of assumptions including assumptions made about the Company’s ability to advance exploration efforts at the Warintza Project; the results of such exploration efforts; and the Company’s ability to advance its projects and achieve its growth objectives. These statements also involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements, including the risks, uncertainties and other factors identified in the latest SolarisManagement’s Discussion and Analysis and Annual Information Form available at www.sedar.com. Furthermore, the forward-looking statements contained in this news release are made as at the date of this news release and Solaris does not undertake any obligation to publicly update or revise any of these forward-looking statements except as may be required by applicable securities laws.

(1) No adjustments were made for recovery as the project is an early-stage exploration project and metallurgical data to allow for estimation of recoveries is not yet available. Solaris defines copper equivalent calculation for reporting purposes only. Copper-equivalence calculated as: CuEq (%) = Cu (%) + 3.33 × Mo (%) + 0.73 × Au (g/t), utilizing metal prices of Cu - US$3.00/lb, Mo - US$10.00/lb and Au - US$1,500/oz.